BANK of the Philippine Islands (BPI) raised P33.7 billion from its offering of 1.5-year Sustainable, Environmental, and Equitable Development (SEED) Bonds, well above its P5-billion goal, it said on Friday.

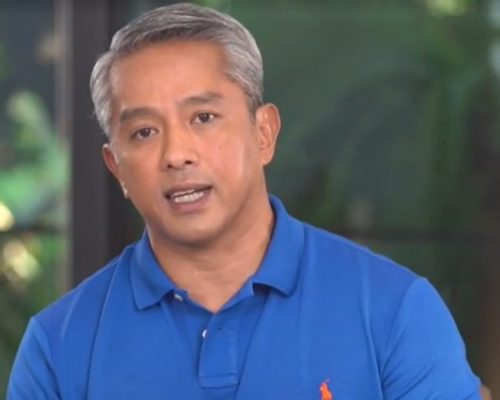

“On behalf of BPI, I am honored to share that our bond offering has been met with remarkable enthusiasm from our investors, resulting in a final issue size of P33.7 billion. I think this is the biggest issue we’ve had, and it’s oversubscribed by more than six times our initial target of P5 billion,” BPI Senior Vice-President, Treasurer and Global Markets Head Dino R. Gasmen said in a speech during the bond listing ceremony held at the Philippine Dealing & Exchange Corp. (PDEx) on Friday.

A third of the issue’s total investors were institutional or non-retail, while the rest came from the high net-worth and retail segment, Mr. Gasmen said.

Demand for the bonds was strong as sustainability-themed investments have been gaining ground in the past years, he added.

“For example, if I’m going to invest in a bond, I want to invest in ESG (environmental, social, and governance) so that I can say that I am doing something on the sustainability side,” he said.

The SEED Bonds issuance marked the third tranche of BPI’s P100-billion bond program approved in May 2022.

The offer marked BPI’s first foray into the sustainable bond space, it said in a disclosure to the stock exchange.

The papers were priced at 6.2% per annum, payable quarterly. BPI sold the bonds from July 19 to Aug. 1, closing the offer period one day ahead of the original schedule amid strong investor demand.

Net proceeds from the SEED Bonds will be used to finance or refinance new or existing eligible green and/or social projects consistent with its Sustainable Funding Framework, BPI previously said.

It added that it will use the offering as an opportunity to promote projects that contribute to the United Nations’ Sustainable Development Goals.

BPI Capital Corp. and Standard Chartered Bank were the joint lead arrangers and selling agents for the bond offer.

Mr. Gasmen said on Friday that the proceeds of the SEED Bonds offer will help fund BPI’s current portfolio of green and social loans.

“The thing is, some of them are going to mature before the bond matures, so there will be a deficit. But our lending units are confident that they will be able to find assets to replace those that are maturing,” he said.

“It’s very important that we find the right assets that conform with our sustainability framework. We don’t want to be accused later on of what they call greenwashing. That’s the most important thing we want to protect because it affects your reputation as an issuer,” Mr. Gasmen added.

The bank’s low-cost current account, savings account (CASA) deposits are also sufficient for BPI’s funding needs, he said.

“We observed that the bank’s CASA deposits are very stable. So, if CASA deposits grow, it will be very difficult for me to justify the issuance of a bond,” Mr. Gasmen said. BPI officials previous said they want to issue sustainability-themed peso bonds every quarter, although this would depend on their funding needs.

BOND LISTINGS ON TRACK TO REACH TARGET

BPI’s latest bond listing brought the total volume of issuances from 14 companies to P266.4 billion year to date, PDEx President and Chief Executive Officer Antonino A. Nakpil told reporters on the sidelines of the ceremony on Friday.

This puts the PDEx on track to reach its target of P400 billion in corporate bond issuances this year, he said.

Trading volume at the exchange reached P1.1 trillion in July, the highest since the P900 billion seen in March 2013, Mr. Nakpil added.

He noted that there were six issuances in the primary market last month, three of which were ESG-themed. Two of these came from the Ayala group, he added.

BPI’s net income grew by 17.5% year on year to P15.3 billion in the second quarter on the back of higher revenues. — A.M.C. Sy